High End Fashion Wallets Painted Pet Rocks

Authored by Lance Roberts via RealInvestmentAdvice.com,

"Pet Rocks" first appeared in the mid-70s as a novelty item. Just recently, digital NFT's of"pet rocks" sold for over $100,000. To wit:

"Rarely practise they create waves for investing in something as dead every bit a rock. Well, they do now.A digital painting of a Greyness-coloured rock, part of a pet project from 2017, has sold for an outrageously high toll.Its non-fungible token (NFT) version was sold for ETH 33 — equivalent to $100,000 (roughly Rs 75 lakhs). These rocks are i of the commencement-ever NFT collectible projects on the Ethereum blockchain. Merely 100 such "pet rocks" were created."

As I noted on my Twitter feed :

"If you don't know what a 'pet stone' is, you are probably too immature to have experienced a existent deport market."

Yes, people really did purchase these and as Peter Atwater noted:

"The Pet Rock craze lasted well-nigh 6 months, beginning in September of 1975, with sales peaking during the Christmas flavour and tanking in February of 1976 when stores discounted prices due to declining sales and copycat products flooding the market." https://t.co/qRutOz8ziN

— Peter Atwater (@Peter_Atwater) August xi, 2021

We have previously discussed the many similarities nosotros see between the height of the markets in 1999 and today. When there is likewise much money chasing as well few assets, digital"pet rocks" are typically a sign of exuberance.

Signs Of A "Rich" Market place

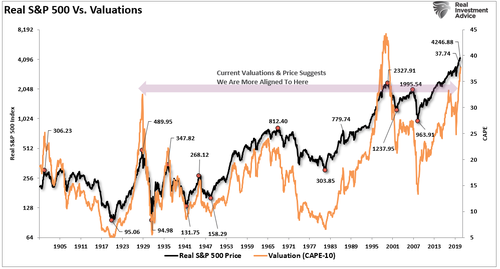

As noted previously, valuations are a terrible market timing indicator.However, in the short term valuations tell yous everything nigh market psychology. In the long term, they tell you everything about expected returns.

Currently, every measure of valuation suggests investors have thrown all"circumspection to the wind."

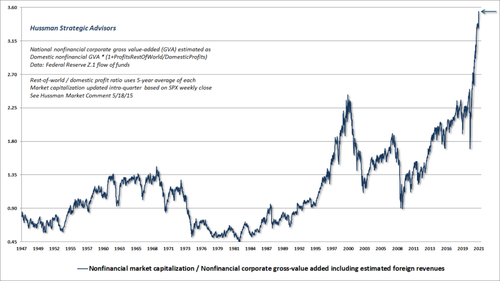

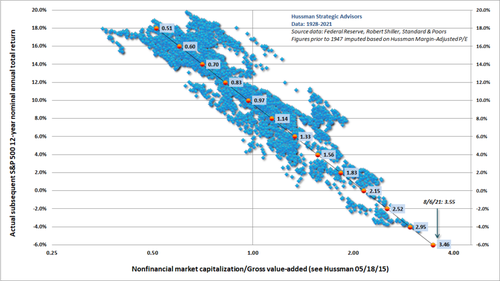

"The nautical chart beneath shows the ratio of nonfinancial market capitalization to corporate gross value-added (MarketCap/GVA), which is the most reliable valuation measure based on its correlation with actual subsequent market returns beyond history. Notably, U.S. nonfinancial gross value-added is at a tape high.The insanity you're looking at is all numerator." – John P. Hussman

There are many rationalizationssuggesting high valuations don't thing due to both ascension inflation and low rates. However, every bit Hussman notes, valuations may be the get-go casualty of sustained inflation.

"Indeed, the South&P 500 has historically underperformed Treasury bills even when inflation is above 2% and college than its level half-dozen-months earlier.Valuations have never been materially above historical norms when CPI inflation was above vi%.And then the "benefit" of high inflation would likely be offset by plunging valuations. "

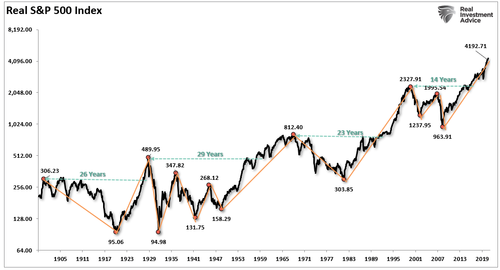

Of course, loftier valuations historically precede long periods of low to negative returns.

"With MarketCap/GVA currently about 3.6 times its historical norm, it would have 22 years of 6% growth to showtime that headwind."

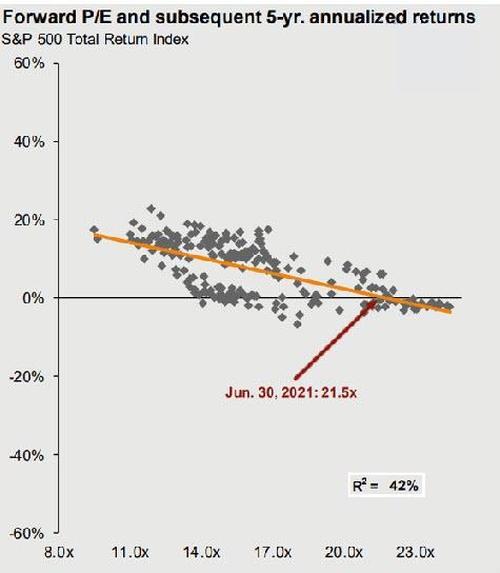

If yous don't like Dr. Hussman's analysis, and then J.P. Morgan likewise produced similar data based on"forward P/E" and subsequent 5-year annualized returns.

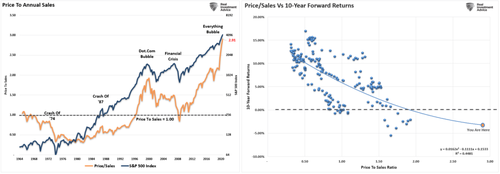

Even price-to-sales are predicting exceptionally low returns over the next decade.

"Currently, the price-to-sales (acquirement) ratio is at the highest level ever. As shown, the historical correlation suggests outcomes for investors will non be kind." – Existent Investment Report

Equally an investor, practice you bet on probabilities or possibilities?

Why You lot Should Choose Black

There is always a tremendous amount of bad communication put out to individual investors to promote a bullish bias. Hither is a good case.

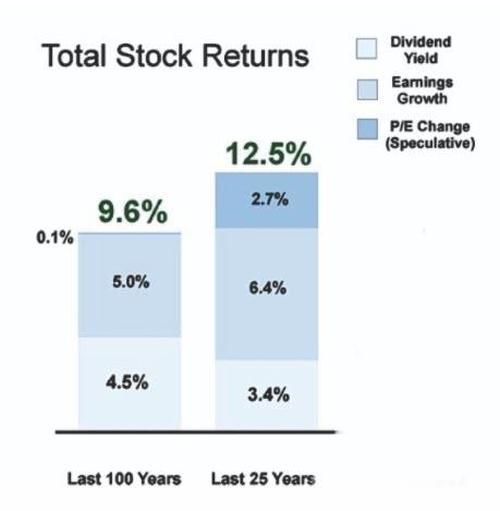

"Disinterestedness total return = DY + earnings growth + delta in P/Due east.

Over the last 100 years, DY has been 3-4% + earnings growth 5-6% on avg. Lower real yields back up P/E. Non owning stocks long-term is like betting blackness for life at a roulette where virtually numbers are blood-red." – @macroalf

At beginning chroma, such would appear to exist a articulate example as to why you should buy and hold an investment portfolio of stocks over the long term.

However, earlier you go betting on"red," at that place are several considerations to exist fabricated.

-

Crimson picked start dates can provide whatsoever result you desire. 100-years agone was 1920. That was the beginning a major bull marketplace cycle that lasted until 1929.However, back up xx-years to 1900, and an investor had to look until the 1950s to breakeven.

-

Starting 25-years agone was 1995. While the run from 1995-2000 was extremely strong, investors then spent the next xiii-years going no where.

-

Lastly, we don't live forever. Y'all can not invest for 100-years. Even 25-years is problematic for many every bit that is the bulk of their savings years before retirement.

Valuations matter over the long term. But, they matter about when it comes to"when" you start your investing journey.

In other words, with valuations at historically high levels, you lot may be better off betting on"blackness."

Retail "Investor" Or "Speculator?"

In today's market, the majority of investors are simply chasing performance. Equally stated, at that place is simply too much money chasing besides few assets.

Just, this isn't"investing," it's"speculation."

Remember about information technology this way.

If you were playing a hand of poker and dealt a"pair of deuces," would you get"all-in?"

Of course, not.

The reason is you lot intuitively understand the other factors"at play." Even a brief agreement of the game of poker suggests other players at the table are probably holding better hands, which will lead to a rapid reduction of your wealth.

Ultimately, investing is about managing the risks that will substantially reduce your ability to"stay in the game long enough" to"win."

Robert Hagstrom, CFA penned a piece discussing the differences betwixt investing and speculation:

"Philip Carret, who wrote The Art of Speculation (1930), believed "motive" was the test for determining the divergence betwixt investment and speculation. Carret connected the investor to the economics of the business and the speculator to price. 'Speculation,' wrote Carret, 'may be defined as the purchase or auction of securities or commodities in expectation of profiting by fluctuations in their prices.'"

Chasing markets is the purest grade of speculation. Information technology is only a bet on prices going college than determining if the price paid for those assets is a discount to fair value.

Graham & Dodd

Along with David Dodd, Benjamin Graham attempted a precise definition of investing and speculation in their seminal workSecurity Analysis (1934).

"An investment performance is one which, upon thorough analysis, promises rubber of chief and a satisfactory return. Operations not meeting these requirements are speculative."

There is also an essential passage in Graham'southThe Intelligent Investor:

"The distinction between investment and speculation in common stocks has always been a useful one and its disappearance is a crusade for concern. We have often said that Wall Street as an institution would be well brash to reinstate this distinction and to emphasize it in all its dealings with the public.Otherwise the stock exchanges may some day exist blamed for heavy speculative losses, which those who suffered them had not been properly warned against."

Surviving The Game

Regardless of whether you believe fundamentals will ever matter again is irrelevant. What is essential is that periods of excess speculation always cease the same style.

If you are one of our younger readers, who have never been through an bodily"conduct marketplace," I wouldn't believe what I am telling you lot either.

However, after living through the Crash of '87, managing money through 2000 and 2008, and navigating the"Great Crash of 2020," I can tell yous the signs are all at that place.

A real bear marketplace will happen. When? I don't have a inkling.

But it volition be an unexpected, exogenous event that triggers the selling.

It always appears easiest at the top. At the bottom, retail investors will not want to buy.

Historically, the environment we are living in currently has not worked out well for investors. However, in the short term, the"irrationality" will last long enough to convince you"this time is different."

"History doesn't e'er repeat itself, just it often rhymes." – Samuel Clemens

0 Response to "High End Fashion Wallets Painted Pet Rocks"

Post a Comment